News

Abiodun wants more Nigerians to benefit from financial services

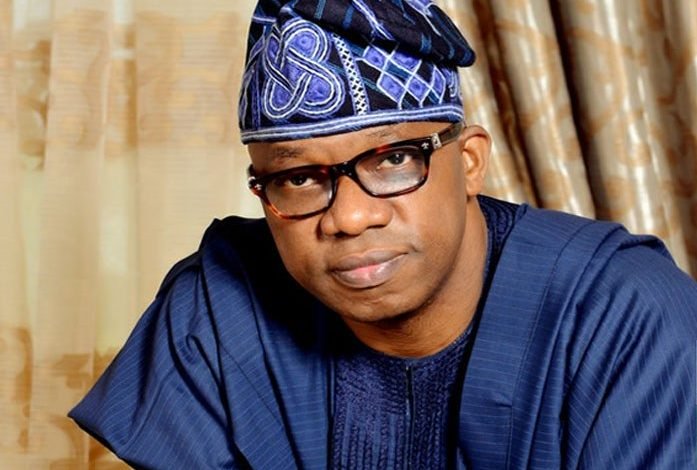

The Governor of Ogun State, Dr Dapo Abiodun, on Friday called on the bankers committee to come up with a system that would allow more Nigerians to benefit from financial services in the country.

Abiodun made the call at the 11th Annual Bankers Committee Retreat with theme: “Delivering Inclusive Growth: Leveraging Digital Finance” in Ogere, Ogun State.

It was reported that the two-day gathering brought together in one room, Chief Executive Officers of commercial banks to dig deep into financial issues concerning the nation.

“To drive inclusive growth, we must find a system that allows more of our people to benefit from financial services such as opening of accounts, providing loans with less stringent efforts and providing financial advice for more of our people, especially participants in MSMEs.

“This is a viable way to boost employment generation, improve food security and accelerate poverty alleviation,” the governor said.

Abiodun also advised the bankers to come up with improved and more pragmatic approaches that would encourage savings and investment, create links between savers and investors and facilitate the expansion of financial markets among others.

He said in doing this, the banking industry would be providing funds to both the MSMEs and the big industries, thereby increasing the country’s national outputs.

The governor advocated the abolition of what he referred to as “using small mans deposit to buy off the big man’s debts”.

“This is the shout of the masses to the bankers committee,” he said.

Earlier, the Central Bank Governor, Dr Godwin Emefiele, said it was imperative to support policy measures that would improve access to finance and credit through digital channels aimed at boosting Nigeria’s economic growth.

“With increased usage of mobile phones by over 87 percent of Nigerians and its ability to support financial transactions through USSD and mobile app channels, the Central Bank of Nigeria has implemented policy measures that will enable underserved Nigerians access finance and credit via mobile devices.

“Individuals are now able to open bank accounts and e-wallets from their mobile devices or through the internet.

“This alternative has resulted in a significant reduction in the cost of providing financial services, relative to traditional brick and mortar system of opening accounts at bank branches.

“Customers are also able to save time and money by conducting transactions on mobile devices, relative to travelling to distant bank branches.

“Advancements in technology such as data analytics, cloud computing, artificial intelligence and cyber security are also working to improve the speed, quality as well as security of financial transactions conducted through digital channels.

“Businesses have better visibility on their income and expenses. Banks, credit bureaux and other financial institutions are also able to leverage these advanced tools in assessing the credit worthiness of customers, by analysing income and payment patterns in e-wallets and bank accounts.

“These advancements are also helping to reduce the reliance on collateral by some financial institutions when providing loans to their customers,” he said.

According to him, increased usage of digital finance tools can also support the development of online platforms that will enable farmers and SMES to sell goods and services to customers.

“Along with an efficient logistics system, safeguards can be put in place to authenticate buyers and sellers, as well as the quality of products being offered.

“Such platforms can support the growth of our farmers, small businesses and by extension financial institutions.

“Farmers, agro processors, and MSMEs should be able to enter in contracts with off-takers for the purchase of their produce without engaging in physical contact with the other party.

“Credit can then be provided on the back of such transactions to support the growth of our farmers and small businesses.

“This will ultimately lead to the expansion of their business activities as they will be in a better position to meet the needs of prospective customers,” he said.

Emefiele said this year’s retreat was coming at a critical time in the nation’s history, when efforts were being made by the monetary and fiscal authorities to structurally rebalance and diversify the Nigerian economy.

Davido's Net Worth & Lifestyle

Davido's Net Worth & Lifestyle