BUSINESS

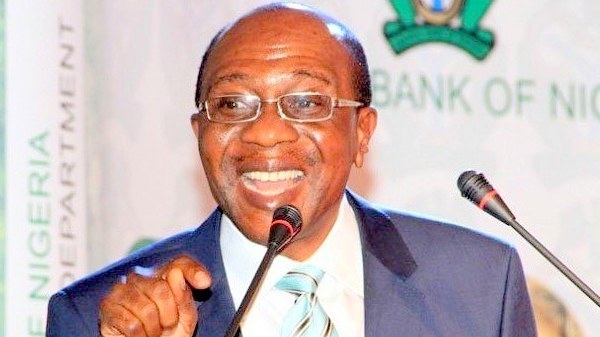

CBN to continue operating managed float exchange rate regime to reduce volatility — Emefiele

The Central Bank of Nigeria (CBN), says it will continue to operate a managed float exchange rate regime to reduce the impact of continuous volatility in the exchange rate on the economy.

The CBN Governor, Mr Godwin Emefiele said this while reeling out the policy road map for his second tenure of five years on Monday in Abuja.

Emefiele said that the bank would support measures that would increase and diversify Nigeria’s export base and ultimately help in shoring up the reserves.

He said while the dynamics of global trade continued to evolve in advanced economies, Nigeria remained committed to a free trade regime that was mutually beneficial.

“We intend to aggressively implement our N500 billion facility aimed at supporting the growth of our non-oil exports, which will help to improve non-oil export earnings.

“We will launch a Trade Monitoring System in October, which is an automated system that will reduce the length of time required to process export documents from one week to a day,’’ he said.

According to him, this measure will help support the bank’s efforts at improving our non-oil exports of goods and services.

“We will also work with our counterparts in the fiscal arm in supporting improved Foreign Direct Investment flows to various sectors such as agriculture, manufacturing, insurance and infrastructure.

“These measures while supporting improved inflows into the country, will help to stabilise our exchange rate and build our external reserves,’’ he said.

Emefiele, while speaking on Financial System Stability, said a resilient and stable financial system was imperative for continued growth of the economy, given the intermediation role that financial institutions played in supporting the needs of individuals and businesses.

According to him, the apex bank will continue to improve its onsite and off-site supervision of all financial institutions.

He said that the bank would leverage on data analytics and its in-house experts across different sectors to improve its ability to identify potential risks to the financial system as well as risks to individual banks.

“In the next five years, we intend to pursue a programme of recapitalising the Banking Industry so as to position Nigerian banks among the top 500 in the world.

“Banks will therefore, be required to maintain higher level of capital, as well as liquid assets in order to reduce the impact of an economic crisis on the financial system.

“With the rise in digital payments and cyber security threats, we will develop a robust mechanism that will help ensure that the necessary safeguards are put in place by banks and financial institutions

“This will help to protect against loss of data, fraud and cyber incursions in their respective systems.’’.

Davido's Net Worth & Lifestyle

Davido's Net Worth & Lifestyle