BUSINESS

CBN to continue to apply monetary policy tools to control Inflation

The Central Bank of Nigeria (CBN) says it will continue to apply monetary policy tools to control the rising inflation.

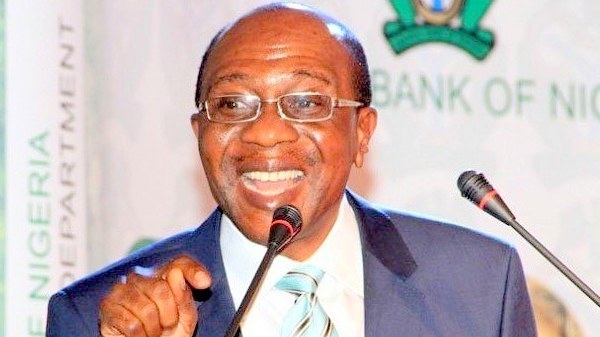

The CBN made the promise in its 2018 financial stability report signed by its Governor, Mr Godwin Emefiele which was released on Thursday.

It was reported that inflation increased to 11.24 per cent in September 2019.

This was disclosed in the latest inflation report released by the National Bureau of Statistics (NBS).

According to the NBS report, inflation rose by 0.22 per cent points, higher than the 11.02 per cent recorded in August and 11.08 per cent for July 2019.

The bank explained that its commitment was necessary following anticipation of increase in inflation in the coming months.

The report indicated that the apex bank would continue to intensify efforts at strengthening the existing synergy between the fiscal and monetary authorities.

According to the report, this will help to ensure policies are complementary in engendering growth and development.

The bank said the Gross Domestic Product (GDP) growth rate sustained its upward trend, largely driven by strong performance in the non oil sector.

The bank also attributed the GDP’s growth to government’s efforts at diversifying the economy and boosting alternative revenue sources.

“The CBN will continue to implement programmes towards supporting the real sector to ensure that the economy remains on a steady trajectory of recovery towards the achievement of its growth projections.

“The report recalls that the bank maintained its non-expansionary monetary policy stance in the second half of 2018 to rein in inflationary pressure,” the report said.

Meanwhile, the bank noted that the potential risks to the stability of the banking system was as a result of high exposure to the oil and gas sector.

The CBN added that though cyber-crime and trade tensions remained.

The report stated that the apex bank had implemented appropriate policies and regulatory measures to significantly minimise the impact of such risks on the Nigerian financial system.

Davido's Net Worth & Lifestyle

Davido's Net Worth & Lifestyle