BUSINESS

Minister lauds NASS speedy consideration of 2020 Finance Bill

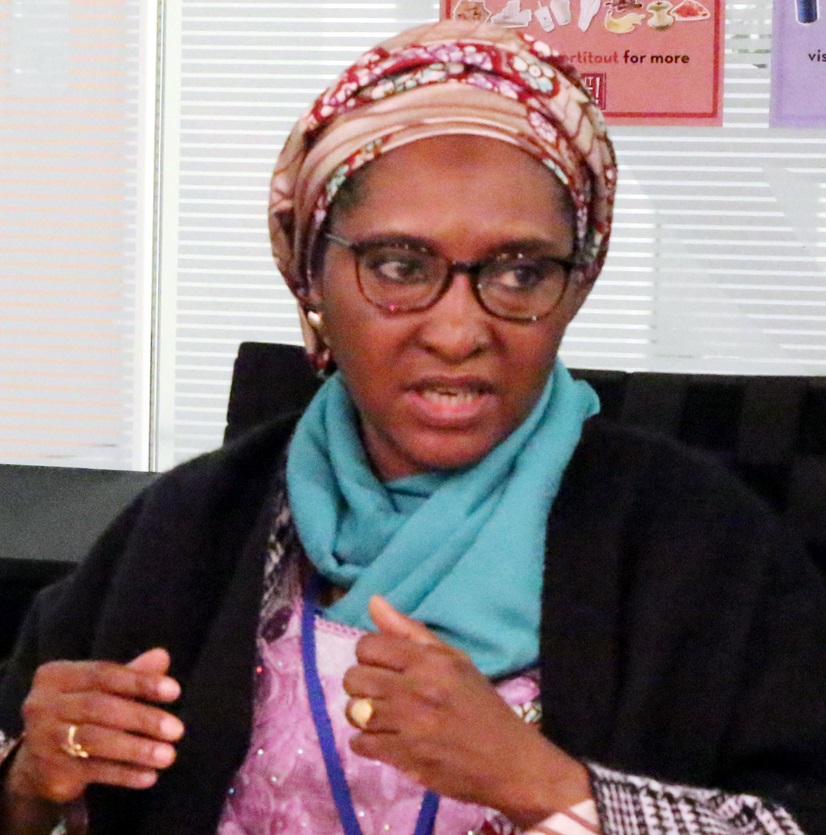

The Minister of Finance, Budget and National Planning, Mrs Zainab Ahmed, has lauded the National Assembly for its speedy consideration of the Finance Bill, 2020 submitted by President Muhammadu Buhari.

Ahmed’s commendation was given in a statement issued on Tuesday in Abuja by her Special Adviser on Media and Communication, Alhaji Yunusa Abdullahi

She described the attention, speed and commitment of the National Assembly to the bill as commendable.

It was reported that the bill, which has passed the second reading at the Senate, was presented to the joint session of the National Assembly on Oct. 14.

“Going forward, the annual budget will always be accompanied by finance bills to enable the realisation of revenue projections.

“Future finance bills will also provide us with additional opportunities to incrementally improve the fiscal policy as well as legal environment in order to further strengthen our domestic capital market and ensure sustained and inclusive growth and development,” she stated.

The minister explained that the bill, among other things, would amend some tax provisions and make them more responsive to the tax reform policies of the Federal Government as well as enhance its implementation and effectiveness.

“This will broaden the triggers for domestic taxation of income earned by non-resident companies in Nigeria through dependent agents and via online market platforms.

“The bill also seeks to address the taxation of industries such as insurance, start-ups, and the capital markets, evaluated by the Federal Government as critical to the growth and development of the Nigerian economy, with a view to stimulating activities in those sectors and fostering overall economic growth.

“Value Added Tax Act, Cap V, LFN 2007 (as amended): In line with global best practice, this Bill proposes to improve the efficiency of the Nigerian VAT system, taking into considerations recommendations from various stakeholder groups.

“In addition to simplifying the VAT landscape, the bill also seeks to expand VAT coverage by addressing some critical issues, such as taxation of the digital economy, VAT registration thresholds and intangibles” the minister explained,” she said.

The minister added that the Customs and Excise Tariff, Cap C49, Laws of the Federation of Nigeria, 2004 was to create a level-playing field for local manufacturers.

According to her, this bill will subject certain imported goods to excise duties in similar manner as their locally-manufactured counterparts.

It was reported that the president forwarded the bill for passage into law by the Senate, pursuant to sections 58 and 59 of the Constitution of the Federal Republic of Nigeria, 1999 (as amended).

The objectives of the bill, as outlined by the president, include to strategically to promote fiscal equity by mitigating instances of regressive taxation, reform domestic tax laws to align with global best practices and introduce tax incentives for investments in infrastructure and capital markets.

Others are to support small businesses, in line with the ongoing Ease of Doing Business Reforms and raise revenues for the government by various fiscal measures, including a proposed increase in the rate of Value Added Tax (VAT) from five to 7.5 percent.

Davido's Net Worth & Lifestyle

Davido's Net Worth & Lifestyle