POLITICS

Senate probes huge difference in deposit, lending interest rates by banks

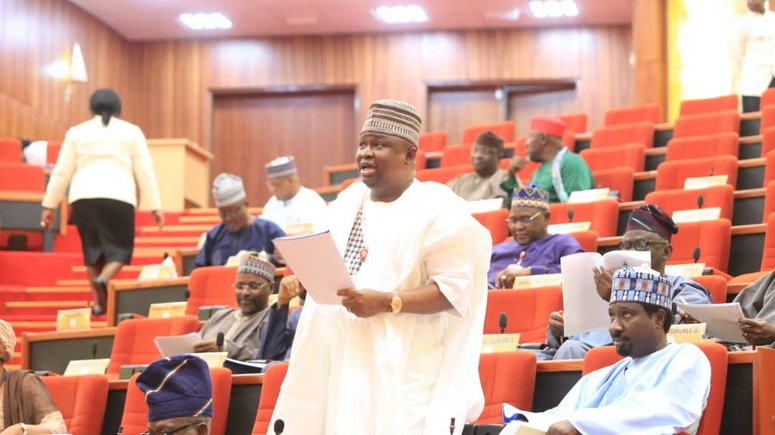

The Senate on Thursday mandated its Committees on Finance, Banking, Insurance and other Financial Institutions to investigate rationale behind huge difference between deposit and lending interest rates among commercial banks and other financial institutions.

The Senate’s resolution is hinged on a motion: “Urgent Need to Reduce the Gap Between Lending Interest Rate and Deposit Interest Rate among Commercial Banks and other Financial Institutions.”

The motion was sponsored by Sen. Solomon Adeola (APC-Lagos).

Adeola in his lead debate noted that there was a huge divergence between the deposit and lending rates in Nigeria.

He said data from Central Bank of Nigeria(CBN)indicates that savings deposit rate as at December 2019 was 3.89 per cent while prime and maximum lending rates were 14.99 per cent and 30.72 per cent in the same period.

He said that Nigeria’s current lending rate was one of the highest in the world, while prime lending rate according to CBN’s Nigeria Monetary Policy Rate (MFR) was 14.99 per cent.

He said loans were available in the commercial banks and other banks at an interest rate of between 22 and 27 per cent.

He said latest data from the National Bureau of Statistics (NBS) also showed that inflation rate further rose from 11.98 per cent in Dec. 2019 to 12.13 per cent in Jan. 2020.

“This development negatively affects the deposits of commercial bank customers in addition to the low interest rates on deposits.

“The interest rate spread in some other African countries are not as wide as that of Nigeria.

“For instance in Kenya. the deposit rate, savings rate and lending rate as at Sept.2019 were 6.89 per cent ,4.58 per cent. and 12.47 respectively”.

He said South African’s overnight deposit rate and lending rate as at February 20 were 6.34 per cent and 9.75 per cent .

He said CBN had not done enough in balancing the deposit and lending rate with the goal of encouraging savings.

He also expressed concern that higher interest rates, interest payments on credit cards and loans were more expensive.

This, Adeola noted discourages people from borrowing and spending while those who already had loans would have less disposable income because they spend more on interest payments.

This, he further noted usually affects production in the real sectors of the economy.

Contributing to the motion, Sen. Barau Jibril (APC-Kano) said the difference in deposit and lending rates was designed to short change Nigerians.

He said the defence in the rates would discourage investors into the country.

He said there was the need for the senate to investigate the matter by inviting the CBN to explain reasons for the huge difference.

Other senators who spoke in support of the motion included, Sen.Sabo Mohammed, (APC-Jigawa), Bala Na’Ala(APC-Kebbi),Uche Ekwunife (PDP-Anambra) among others.

The senators condemned the huge difference in the deposit and lending rates noting that the development was designed to rip-off Nigerians and stall growth of businesses in the country.

Davido's Net Worth & Lifestyle

Davido's Net Worth & Lifestyle