BUSINESS

CBN unveils plans for non-interest facility in ABP, others

…Targets N432 billion for 2020 Wet Season

The Central Bank of Nigeria (CBN) has unveiled plans to release a framework for the integration of non-interest window in all its intervention programmes, particularly the Anchor Borrowers’ Programme (ABP) and the Targeted Credit Facility (TCF) to support households and Micro, Small and Medium Enterprises (MSMEs) affected by the COVID-19 pandemic.

The Bank also plans to fund the value chains of nine commodities to the tune of N432 billion in the 2020 wet season.

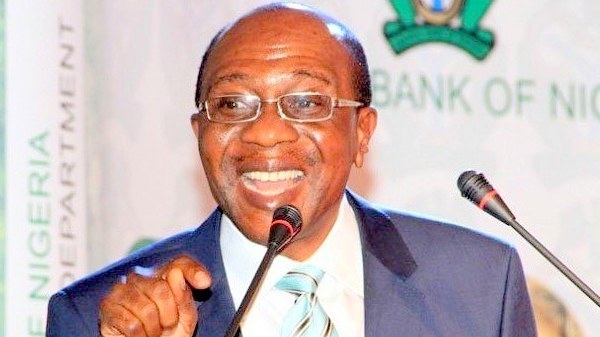

These were disclosed by the duo of the Bank’s Director, Corporate Communications, Isaac Okorafor and Yila Yusuf, the Director, Development Finance Department, who jointly represented the CBN Governor, Mr. Godwin Emefiele, at a stakeholder meeting on Thursday, June 18, 2020, to review the successes recorded under the ABP and the strategies for the 2020 agricultural wet season.

According to Okorafor, the creation of a non-interest window followed appeals by concerned stakeholders for farmers across the country to also be considered for funding under the non-interest window.

While revealing that work had been concluded on the funding document, he said the policy would be issued shortly outlining how farmers under the category could apply and benefit from the agricultural programmes of the CBN.

Okorafor said the Bank, in the 2020 agricultural wet season, was committed to aggressively fund its agricultural programmes and spur farmers along select crop value chains to prevent the country from sliding into a recession, as is currently being experienced in some major economies of the world.

Speaking on the Targeted Credit Facility (TCF) of the Bank aimed at alleviating the impact of the coronavirus on individuals and small businesses, Okorafor noted that the Bank was determined to push the economy to ensure Nigeria does not experience consecutive quarters of negative growth.

Accordingly, he said that the Governor, Mr. Emefiele, had directed the Development Finance Department of the Bank as well as the NIRSAL Micro-Finance Bank (NMFB) to fast-track the approval process of loans, which he stressed were to help restore businesses and livelihoods.

In his remarks, the Director, Development Finance Department of CBN, Mr. Yila Yusuf, said the target for the 2020 agricultural wet season was to advance about N432 billion, through the participating banks, in the value chains of nine commodities. He also disclosed that over 1.1 million farmers, cultivating over one million hectares of farmland, were expected to benefit from the loans that will help to produce a collective output of 8.3 million metric tons.

According to Yusuf, the focus for the 2020 wet season is to ensure the provision of improved seeds to incentivize the farmers to return to their farms. He also stressed that the CBN adopted the value chain approach across all the commodities to ensure that every player along the entire value chain, from the farmers through to the processors, was financed.

He said the Bank’s funding of the Anchor Borrowers’ Programme (ABP) for the 2020 season was the highest since the inception of the programme in 2015, adding that this was quite significant considering the successes recorded in the 2019 season that contributed to shielding Nigeria from any food shortage, particularly rice, in the heat of the global lockdown during which some major producing countries of staples, such as rice, closed their silos and halted the export of those produce from the shores of their respective countries.

Also speaking at the meeting, the Presidents of the Rice Farmers Association of Nigeria (RIFAN) – Alhaji Alhaji Aminu Goronyo; National Cotton Association of Nigeria (NACOTAN) – Mr. Anibe Achimugu; Maize Association of Nigeria (MAN); Maize Association of Nigeria (MAAN) – Alhaji Bello Abubakar; and the Maize Growers, Processors, and Marketers Association of Nigeria (MAGPMAN) – Dr. Edwin Uche attested to the success of the ABP, which they noted had enhanced the value chains of their respective commodities.

While pledging their support to the continued implementation of the Anchor Borrowers’ Programme to generate employment and create wealth, the association presidents also promised to ensure that the loans collected by farmers were promptly recovered in order to sustain the programme.

Davido's Net Worth & Lifestyle

Davido's Net Worth & Lifestyle