BUSINESS

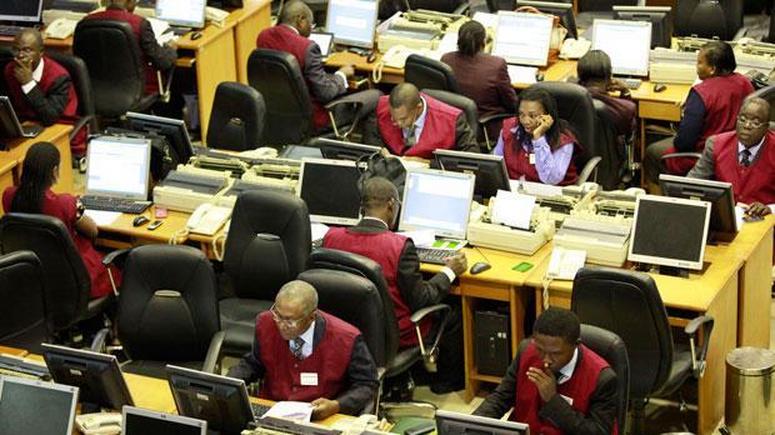

Investors earn N94bn on NGX, index up 0.47%

Transactions on the Nigerian Exchange (NGX) closed Monday upbeat with a N94 billion growth.

Specifically, the market capitalisation returned to the N20 trillion mark, increasing by N94 billion to close at N20.034 trillion from N19.940 trillion on Friday.

Also, the All-Share Index rose by 180.89 or 0.47 per cent to close at 38,437.88 against 38,256.99 achieved on Friday.

Accordingly, the month-to-date and year-to-date losses moderated to 3.5 per cent and 4.6 per cent, respectively.

The gain was driven by price appreciation in large and medium capitalised stocks amongst which are; BUA Cement, MTN Nigeria Communications, MRS Oil, Vitafoam and Julius Berger.

However, the market recorded 23 laggards in contrast with 18 gainers.

MRS Oil dominated the gainers’ chart in percentage terms with 9.57 per cent to close at N12.60 per share.

Vitafoam followed with 8.91 per cent to close at N11, while Chams rose by five per cent to close at 21k per share.

PZ Cussons grew by 3.77 per cent to close at N5.50, while AIICO Insurance gained 3.45 per cent to close at N1.20 per share.

On the other hand, Royal Exchange led the losers’ chart in percentage terms by 9.88 per cent to close at 73k per share.

Consolidated Hallmark Insurance followed with a loss of 9.59 per cent to close at 66k, while Neimeth International lost 8.51 per cent to close at N1.72 per share.

Mutual Benefits Assurance dipped 8.33 per cent to close at 44k, while Regency Alliance Insurance shed 8.16 per cent to close at 45k per share.

However, the total volume of shares traded decreased by 11.73 per cent to 201.86 million shares valued at N2.12 billion exchanged in 3,827 deals.

This was against 228.67 million shares worth N3.67 billion transacted in 3,318 deals on Friday.

Transactions in the shares of Veritas Kapital Assurance topped the activity chart with 29.78 million shares valued at N5.96 million.

Fidelity Bank followed with 24.47 million shares worth N54.17 million, while Zenith Bank traded 20.93 million shares valued at N481.18 million.

Access Bank sold 15.40 million shares worth N126.37 million, while FBN Holdings transacted 10.13 million shares valued at N72.34 million.

Davido's Net Worth & Lifestyle

Davido's Net Worth & Lifestyle