BUSINESS

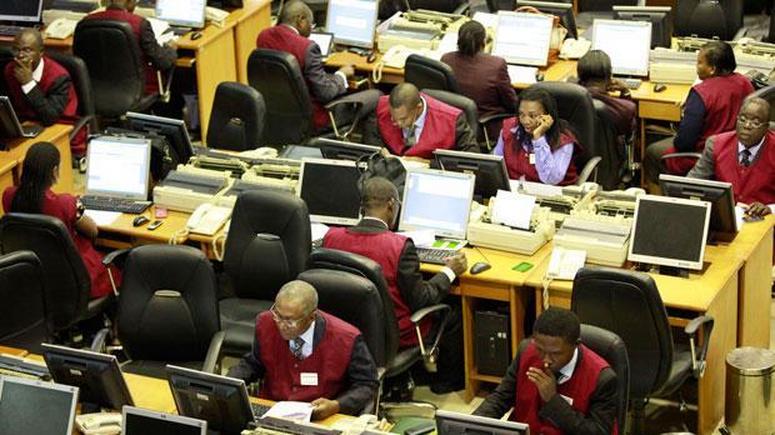

NGX market capitalisation opens week with N20bn loss

Activities in the nation’s bourse resumed the week on Monday still on a negative trend following investors sentiment on the banking, insurance and consumers goods sectors.

Accordingly, the All-Share Index ended the session with a loss of 37.45 points or 0.10 per cent to close at 38,906.42 against 38,943.87 achieved on Friday.

Consequently, the month-to-date and year-to-date losses increased to 0.8 per cent and 3.4 per cent, respectively.

Similarly, the market capitalisation dipped N20 billion to close at N20.270 trillion from N20.290 trillion posted on Friday.

The market loss was driven by price depreciation in large and medium capitalised stocks amongst which are; Guaranty Trust Holding Company, PZ Cussons, Unilever, Zenith Bank and Cutix.

For the week, analysts at United Capital Plc expected investor sentiment to remain weak amid a dearth of positive triggers.

Analysts at Afrinvest Ltd said: “We expect to see positive performance in subsequent trading sessions, driven by buying interest as investor sentiment builds up.”

However, the market breadth closed at par with 19 losers and 19 gainers.

SCOA led the losers’ chart in percentage terms by 9.43 per cent to close at 96k per share.

Veritas Kapital Assurance followed with 8.70 per cent to close at 21k, while Linkage Assurance lost 6.56 per cent to close at 57k per share.

PZ Cussons dropped 5.98 per cent to close at N5.50, while Cornerstone Insurance shed 5.77 per cent to close at 49k per share.

On the other hand, Consolidated Hallmark Insurance dominated the gainers’ chart in percentage terms, by 9.62 per cent to close at 57k per share.

Chams followed with 9.52 per cent to close at 23k, while Courteville Business Solutions rose by 6.90 per cent to close at 31k per share.

Wema Bank increased by 3.95 per cent to close at 79k, while Nigerian Aviation Handling Company gained 3.62 per cent to close at N3.15 per share.

Transactions in the shares of Ekocorp topped the activity chart with 40 million shares valued at N231.60 million.

United Bank for Africa followed with 10.81 million shares worth N82.23 million, while Transcorp traded 9.75 million shares valued at N8.91 million.

Sovereign Trust Insurance accounted for 9.64 million shares valued at N2.33 million, while Fidelity Bank sold 9.25 million shares worth N22.19 million.

In all, the total volume of trades increased by 23.1 per cent as investors bought and sold 190.96 million units valued at N2.35 billion exchanged in 3,462 deals.

This was against a total of 155.09 million shares worth N1.95 billion traded in 2,906 deals on Friday.

Davido's Net Worth & Lifestyle

Davido's Net Worth & Lifestyle