BUSINESS

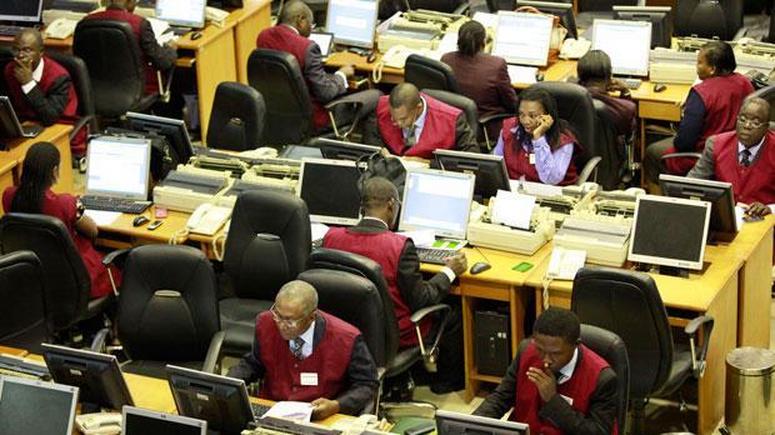

Profit taking persists on NGX, indices down by 0.03%

Trading on the nation’s bourse remained bearish on Thursday with the market capitalisation dropping further by N7 billion on sustained profit taking.

Specifically, the market capitalisation lost N7 billion or 0.03 per cent to close at N22.043 trillion from N22.050 trillion posted on Wednesday.

Also, the All-Share Index which opened at 42,244.22 dipped 13.74 points or 0.03 per cent to close at 42,230.48.

Accordingly, month-to-date and year-to-date returns printed 2.4 per cent and 4.9 per cent, respectively.

The market negative performance was driven by price depreciation in large and medium capitalised stocks which are; Julius Berger, MTN Nigeria Communications (MTNN), FBN Holdings (FBNH), Zenith Bank and United Capital.

Analysts at Afrinvest Ltd said that: “We expect the negative sentiment in the market to be sustained in the absence of any positive catalyst.”

However, the market sentiment closed positive with 14 stocks gaining, relative to 11 decliners.

Julius Berger led the losers’ chart in percentage terms by 9.88 per cent to close at N22.35 per share.

UACN Property Development Company (UPDC) followed with 5.60 per cent to close at N1.18, while Sovereign Trust Insurance lost four per cent to close at 24k per share.

FBNH lost 2.50 per cent to close at N11.70, while Honeywell Flour Mills shed 1.43 per cent to close at N3.45 per share.

On the other hand, Union Bank of Nigeria drove the gainers’ chart in percentage terms by 9.78 per cent to close at N5.05 per share.

Royal Exchange followed with 7.14 per cent to close at 75k, while Mutual Benefits Assurance was up by 6.67 per cent to close at 32k per share.

Eterna appreciated by six per cent to close at N5.30, while Oando rose by 5.26 per cent to close at N4.60 per share.

The total volume of shares traded decreased by 5.8 per cent to 211.09 million units valued at N2.46 billion exchanged in 2,815 deals.

This was in contrast with 224.03 million shares worth N2.66 billion traded in 2,677 deals on Wednesday.

Transactions in the shares of UAC of Nigeria topped the activity chart with 64.95 million shares valued at N617.02 million.

Sovereign Trust Insurance followed with 23.31 million shares worth N5.48 million, while Guaranty Trust Bank Holding Company traded 21.14 million shares valued at N549.57 million.

Jaiz Bank traded 14.95 million shares valued at N9.57 million, while Unity Bank transacted 7.97 million shares worth N3.78 million.

Meanwhile, the Board of Union Bank of Nigeria (UBN) notified the Nigerian Exchange Group (NGX) and the Securities Exchange Commission (SEC) of the intention of its core investors (Union Global Partners Limited, Atlas Mara Limited and others) to divest their shareholdings in UBN to Titan Trust Bank Ltd.

Davido's Net Worth & Lifestyle

Davido's Net Worth & Lifestyle