BUSINESS

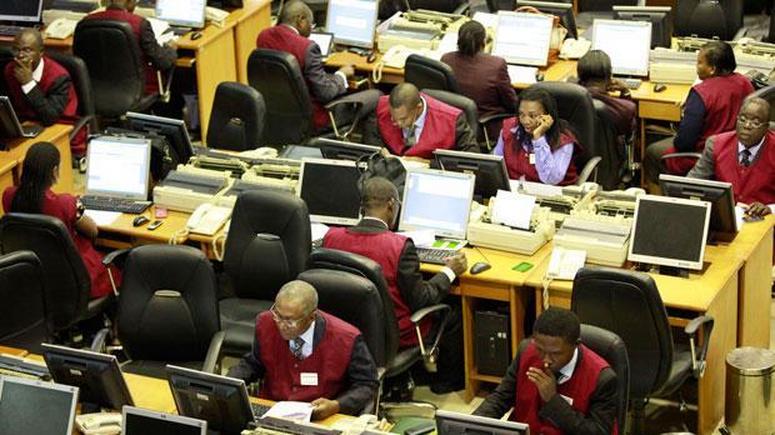

NGX improves further by N71bn

The domestic equities market sustained its positive run on Thursday as demand for Lafarge Africa and FBN Holdings spurred a third consecutive gain in the market.

Specifically, the All-Share Index inched higher by 131.19 points or 0.30 per cent to close at 43,607.94 from 43,476.75 posted on Wednesday.

Accordingly, the year-to-date return increased to 2.1 per cent.

Also, the market capitalisation gained N71 billion or 0.30 per cent to close at N23.497 trillion from N23.426 trillion achieved on Wednesday.

The performance was impacted by gains recorded in medium and large capitalised stocks, amongst which are: BUA Foods, Lafarge Africa, Nigerian Exchange Group, UACN and United Capital.

Analysts at Afrinvest Ltd. said, “In the final trading session, we expect the local bourse to extend the positive momentum as investor sentiment continues to build up.”

Market sentiment was positive with 24 losers relative to 13 gainers.

A breakdown of the price movement chart shows that BUA Foods drove the gainers’ table in percentage terms with 10 per cent to close at N48.40 per share.

Academy Press followed with 9.09 per cent to close at 60k, while Meyer was up by 8.70 per cent to close at 50k per share.

Regency Alliance Insurance rose by 6.67 per cent to close at 48k, while Livestock Feeds appreciated by 6.22 per cent to close at N2.05 per share.

On the other hand, SUNU Assurance led the losers’ chart in percentage terms by 9.76 per cent to close at 37k per share.

NEM Insurance followed with 7.78 per cent to close at N4.15, while FTN Cocoa processors depreciated by 7.69 per cent to close at 36k per share.

Oando declined by 5.15 per cent to close at N4.60, while Unilever Nigeria depreciated by 3.45 per cent to close at N14 per share.

Meanwhile, the total volume of trades decreased by 85.9 per cent with 174.61 million units valued at N2.13 billion exchanged in 3,715 deals.

This was in contrast with a total of 1.24 billion shares worth N42.97 billion traded in 4,032 deals on Wednesday.

Transactions in the shares of FBN Holdings (FBNH) topped the activity chart with 27.09 million shares valued at N307.29 million.

United Bank for Africa followed with 22.03 million shares worth N177.52 million, while Transcorp traded 11.99 million shares valued at N11.73 million.

BUA Foods traded 11.29 million shares valued at N544.69 million, while Zenith Bank transacted 10.27 million shares worth N260.60 million.

Davido's Net Worth & Lifestyle

Davido's Net Worth & Lifestyle