News

NIPOST plans to enhance financial inclusion, introduces e-debit cards

The Nigerian Postal Service (NIPOST) is set to enhance financial inclusion among Nigerians through its ongoing reforms of the postal sector.

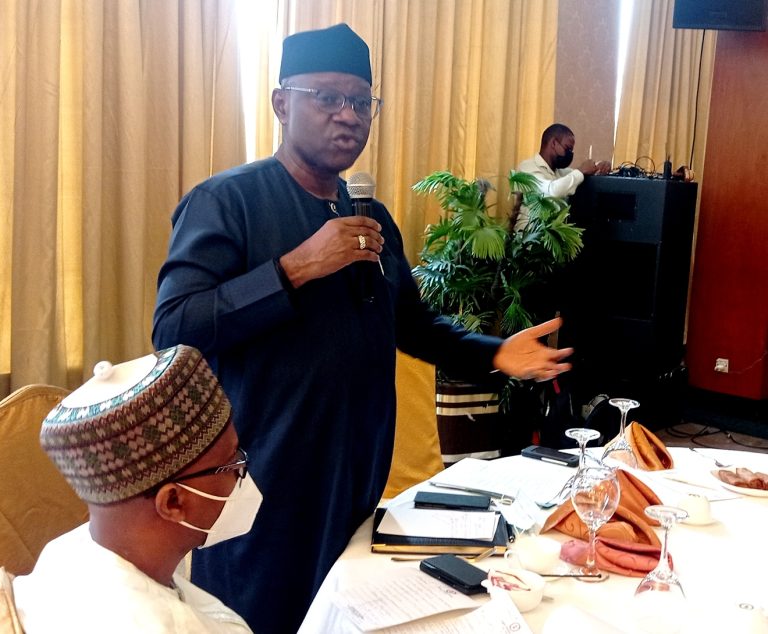

The Postmaster-General of NIPOST, Dr Ismail Adewusi, gave the hint in an interview with our correspondent in Lagos.

Adewusi spoke to our correspondent while he accompanied Prof. Isa Pantami, the Minister of Communication and Digital Economy, to Lagos for a breakfast session with start-up digital innovation stakeholders on Tuesday.

He said that one of the giant steps in the reform approach would be the launch of the e-debit card “to achieve what we call a very pronounced financial inclusion”.

According to Adewusi, with an e-debit card, the post office will be a one-stop shop.

“You can go to a post office withdraw money, you can pay cash, you can transfer money and you can use it to pay for your other services,” he told our correspondent.

He said that technology, with its disruptive nature, had affected the traditional postal business across the world.

“Despite the difficulties encountered because of technology, the postal industry has had a very critical role to play in advancing the common good of financial inclusion by making services available to under-banked communities across the world.”

“The role of the post office today is much more dynamic than it had ever been in the past.”

“The post office was known for carrying letters and delivering parcels in the past; but today; the post office is the biggest bank in China, with over 800million customers and a very huge capital base.”

He explained that the e-debit card would serve as a very useful instrument to galvanise financial inclusion in many parts of the country.

“We are getting 52 million unbanked people into the Nigeria bank index and the response has been marvellous.”

“We’ve seen a substantial response and as we speak, about one million e-debit cards had been issued,” Adewusi said.

He added, “Very soon, you will see that NIPOST will become a very important financial settlement platform”.

He said that part of the plans was to establish microfinance banks across several centres in the country.

“We are just waiting for the operating licence to be issued by the Central Bank to enable us proceed with other arrangements for establishing the microfinance banks.”

“We will ensure that this is done this year; and once the licence is out, we can fast-track the process.”

The Postmaster-General also gave an update on the NIPOST/e-Gate Egypt, a bilateral partnership on “Digital Transformation” of logistics and Last-Mile Delivery Chain services.

“As we speak, the platform is ready; it is now going through the proof of concept (POC).”

He said that the platform would be launched next month.

“I can tell you, it will be a game-changer for the national postal service in our quest to further deliver on our mandate of delivering postal service seamlessly.”

“Egypt is working with us just as it is working with several other African countries under the Pan African Postal Union.”

“I think it’s a very worthwhile initiative. It will take us away from running up and down looking for funding to drive most of the businesses that we do because the major constraints facing NIPOST today is infrastructure.”

“We don’t have the resources to put in place the needed infrastructure to do the last mile delivery of mails and parcel cargoes.”

According to him, The e-Gate Egypt arrangement will solve most of these problems and Nigeria can begin to compete favourably with players in the private sector.

Davido's Net Worth & Lifestyle

Davido's Net Worth & Lifestyle