BUSINESS

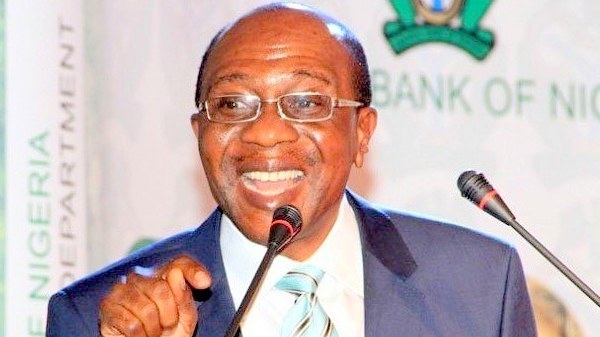

Banking Industry: Emefiele pushes for more women in top management

Mr Godwin Emefiele, Governor, Central Bank of Nigeria (CBN), on Thursday, said that the bank had issued gender-mandated regulations to pave way for gender diversity and inclusiveness at the top management levels in the banking industry.

Emefiele made the disclosure at a webinar hosted by the Deputy Governor in charge of Financial System Stability (FSS) Directorate, Mrs Aishah Ahmad, as part of activities to commemorate the 2022 International Women’s Day at the CBN office in Abuja.

The webinar had the theme: “Gender Equality Today for a Sustainable Tomorrow”.

The governor said that the bank had since surpassed the affirmative action with 32 per cent of the total workforce being female.

Emefiele also said that the CBN had issued a policy that required a minimum of 30 per cent of female representation on boards and 40 per cent at the top management level in the banking industry.

This, he said, was similar to the national financial inclusion strategy, recommending increasing female staff of microfinance banks to 30 per cent.

He said that the bank had been using the gender diversity model as part of the criteria for approving the membership of boards of institutions under its regulatory purview, geared toward increased representation of women in the industry.

He explained that such gender mandates were necessary to breaking the bias in the Nigerian banking industry, stressing that eight out of the 23 bank CEOs, representing 35 per cent, were women which was way above the global average.

He said in recognition of the significance of empowering women to be part of the solution to the climate change crisis.

He also said that the campaign theme for 2022, (#BreakTheBias) aimed to raise awareness on the persistent bias and discrimination in communities, workplaces, schools and the society in order to create a “gender equal world” that would be “diverse, equitable and inclusive”.

Emefiele added that the bank, under his watch had demonstrated its commitment to diversity and inclusiveness by designing and implementing a wide variety of initiatives, programmes and interventions to promote entrepreneurship, reduce poverty, generate employment and deepen financial inclusion for women.

“Females have benefitted hugely from the bank’s intervention programmes, such as the Agribusiness Small and Medium Enterprise Investment Scheme (AGSMEIS) and the COVID-19 Targeted Credit Facility (TCF).

“Specifically, out of N134.67 billion disbursed to 37,273 AGSMEIS beneficiaries, as of January 2022, 33 per cent (N44.1 billion) went to 12,511 female beneficiaries.

“Similarly, out of N349.51 billion disbursed to 712,442 total beneficiaries under the TCF, 45 per cent which was N159.21 billion went to 330,128 female beneficiaries,

“The MSME Development Fund (MSMEDF) was designed to allocate at least 60 per cent of the fund to women and women-owned enterprises of which 60.3per cent of the of 229,579 beneficiaries are women.

”Furthermore, out of the 211,306 financial statements currently registered in the collateral registry, 92,091, representing 43.6 per cent were female borrowers,” Emefiele said.

Citing reports to support claims about gender parity in the workplace, among other issues bordering on discrimination, Emefiele said that CBN recognised the positive impact of gender parity on the economy, achieving the SDGs and climate targets.

He also noted that women had been disproportionately affected by both the COVID-19 pandemic and the effects of climate change, hence, the bank was using the 2022 IWD as an opportunity to celebrate women who were in the frontline of the twin-crisis.

He said the bank was taking strategic actions in areas of recruitment, retention, succession planning, and return-to-office work arrangements to address the gender gaps, even as he declared that the CBN had since surpassed the affirmative action with 32 per cent of the total workforce being female.

“It is only by unleashing the full potential of women to participate fully in the economy that we can strengthen growth, eliminate poverty, create jobs and respond effectively to the mounting global challenges, from the pandemic to climate change,” Emefiele said.

Earlier, Mrs Aishah Ahmad, Deputy Governor, Financial System Stability, expressed appreciation to the Governor and other Deputy Governors for their constant support toward women and their wellbeing.

She said that remembering the day was an opportunity to celebrate women for their progress, achievements and contributions to the society.

Ahmad urged that age, ethnicity, religion and other biases be broken for women to realise and fulfil their full potential without which a sustainable future would not be achievable.

Mrs Elsie Awadzie, Second Deputy Governor, Bank of Ghana, challenged women to change the narratives in their minds and break the biases they had created against themselves.

She urged them to support, believe in one another and mentor one another to lift up one another.

She stressed the need for women to consciously and intentionally seek alliances when necessary and cultivate meaningful relationships toward mutual respect and consideration.

She, therefore, urged every woman to be the light that others seek to follow, adding that “it takes boldness, courage, sheer resilience and excellence to succeed as a woman in the 21st century”.

Ms Comfort Lamptey, the Representative of UN Women to Nigeria and ECOWAS, urged women to strive to achieve a healthy work-life balance.

According to her, passion and commitment are key attributes for success in any endeavor.

The Special Adviser to the CBN Governor on Sustainable Banking, Dr A’isha Mahmood, thanked the Governor and deputy governors for their support toward the success of the programme, noting that the IWD celebrations had over the years evolved to being a day for appreciation, respect and recognition for the women folk.

She added that creating a more equal world today was a collective responsibility and a foundation on which a sustainable tomorrow could be built.

Davido's Net Worth & Lifestyle

Davido's Net Worth & Lifestyle