BUSINESS

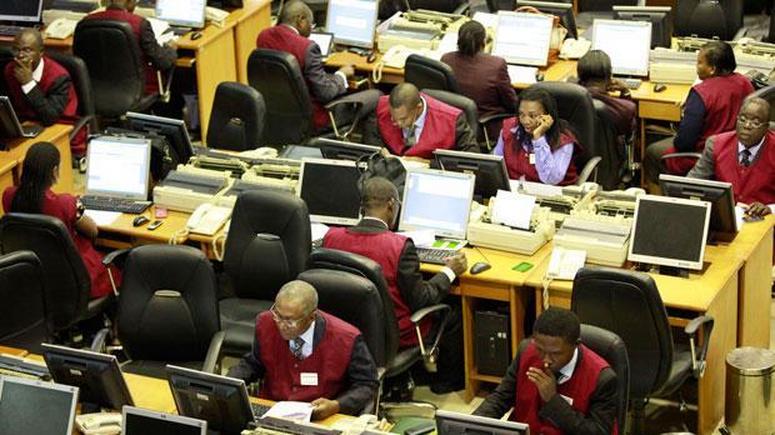

Trading closes southward on NGX, losses N52bn

The bears resurfaced at the Nigerian Exchange Ltd.,(NGX) on Tuesday as a result of profit taking in MTN Nigeria and 11 other stocks.

Accordingly, the All-Share Index declined by 97.07 basis points or 0.19 per cent to close at 51,805.41 from 51,902.48 recorded on Monday.

Consequently, the year-to-date (YTD) return fell to 21.28 per cent.

Similarly, the market capitalisation shed N52.36 billion to close at N27.928 trillion compared with N27,981 trillion posted on Monday.

The market negative performance was driven by profit taking in telecommunication, consumer goods and Tier-1 banks which are MTNN, Nigerian Breweries Company, Zenith Bank and United Bank for Africa(UBA).

However, the market breadth closed positive with 34 gainers as against 12 losers.

NAHCO led the laggards’ chart by 4.12 per cent to close at N6.51 per share.

Mutual Benefits Assurance followed with 3.85per cent to close at 25k, while Wema Bank was down by 3.73 per cent to close at N3.61 per share.

MTN Nigeria depreciated by 3.61 per cent to close at N240, while Regal Insurance declined by 3.33 per cent to close at 29k per share.

Conversely, Multiverse Mining and Exploration, MayBaker and Okumu Oil topped the gainers’ chart in percentage terms by 10 per cent each to close at 22k N4.84 and N187 per share, respectively.

Champion up by 9.81 per cent to close at N4.03 while McNicholas appreciated by 9.78 per cent to close at N1.01per share.

Transactions in the shares of Guaranty Trust Bank Holding Company (GTco) topped the activity chart with 51.96 million shares valued at N1.23 billion.

Transcorp followed with 44.33 million shares worth N49.62 million, while First Bank of Nigeria Holdings (FBNH) traded 14.09 million shares valued at N171.28 million.

Oando traded 13.6 million shares valued at N80.86 million, while Regal Insurance traded 11.98 million shares worth N3.31 million.

In all, the total volume traded depreciated by 1.10 per cent to 331.32 million shares worth N5.04 billion traded in 6,689 deals.

This was against a total of 377.56 million shares valued at N5.55 billion transacted in 7,684 deals on Monday.

The value of transactions declined by 7.95 per cent.

Davido's Net Worth & Lifestyle

Davido's Net Worth & Lifestyle