BUSINESS

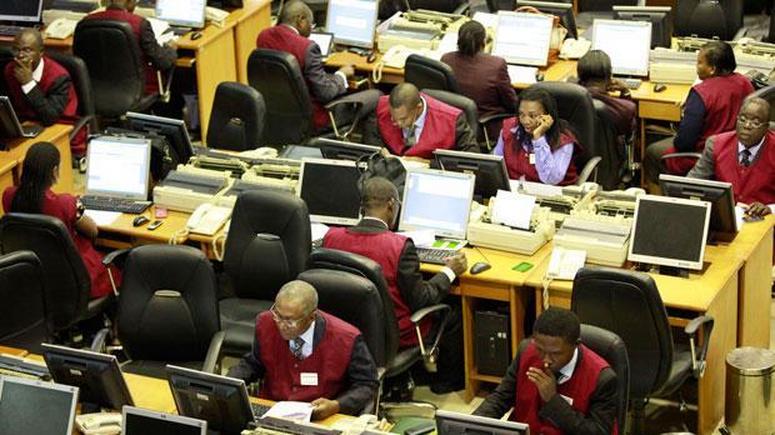

NGX: Crucial performance indicators drop by 0.01%

The Nigerian Exchange Ltd. (NGX) on Monday lost 2.91 billion as market capitalisation closed at N26.794 trillion, representing 0.01 per cent when compared with N26.797 trillion recorded on Friday.

Similarly, the All-Share Index, which opened with 49,682.15 declined by 5.4 basis point or 0.01 per cent to close at 49,676.75.

As a result, the Year-to-date (YTD) return fell to 16.29 per cent.

Analysis of today’s market activities showed trade turnover settled lower relative to the previous session, with the value of transactions down by 54.12 per cent.

In all, investors bought and sold 222.66 million shares valued at N2.13 billion achieved in 4.350 deals.

Market breadth closed positive with 16 stocks advancing, while eight declined.

ITrans-Nationwide Express led the gainers with 9.52 per cent to close at 69k per share.

UPDC Real Estate Investment Trust followed with a gain of 9.23 per cent to close at N3.55, Multiverse Mining & Exploration rose by 9.17 per cent to close at N2.62 per share.

Also Vitafoam Nigeria advanced by 8.37 per cent to close at N22 per share and Courtville inched up by 6.67 per cent to 52k.

On the losing side, Caverton Offshore Support Group led the laggard’s table with a depreciation of 9.57 per cent to close at 1.04 per share.

John Holt followed by dropping 8.99 per cent to close at 81k, while Japaul Gold and Ventures fell by 8.82 per cent to close at 31k.

Aiico Insurance declined by 3.64 per cent to close at 53k, and Nigerian Breweries depreciated by 2.86 per cent to close at N2.10 per share.

Jaiz Bank recorded the highest volume of shares, trading 40.4 million shares worth N36.17 per cent.

It is followed by Access Holdings that sold 35.8 million shares valued N293.56.

Also, FBN Holdings transacted 23.1 million shares, amounting to N251.38 and Mutual Benefits Assurance sold 19.94 million shares worth N6.6 million.

Zenith Bank recorded 12.45 million shares valued at N273.66.

On the performance of the market, analysts at GTI Research said, “We expect mixed reactions to continue this week.”

Davido's Net Worth & Lifestyle

Davido's Net Worth & Lifestyle