BUSINESS

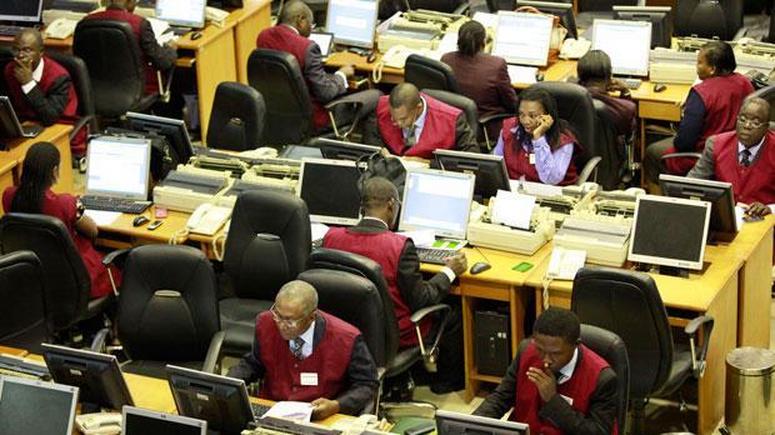

NGX: Capitisation drops by N38bn

The Nigerian Exchange Ltd. (NGX) started the week on a negative note as market capitalisation stood at N26.767 trillion, representing a 0.14 per cent decrease from the N26.805 trillion recorded on Friday.

Also, the All-Share-Index (ASI) shed 69.41 basis points or 0.14 per cent to close at 49,625.71 as against 49,695.12 the previous session.

Market breadth closed with 13 stocks that gained and lost, respectively.

Multiverse Mining & Exploration led the gainers’ table during the day, gaining 9.32 per cent to close at N2.58 per share.

FTN Cocoa Processors followed with a gain of 6.67 per cent to close at 32k, while Chams added 6.45 per cent to close at 33k per share.

Academy Press appreciated by 4.76 per cent to close at N2.20 and Regency Alliance Insurance rose by 2.04 per cent to close at 25k per share.

On the other hand, Beta Glass Company topped the losers’ chart, shedding 9.96 per cent to close at N46.10 per share.

Learn Africa trailed with a loss of 8.89 per cent to close at N2.05, while NEM Insurance declined by 7.96 per cent to close at N5.20 per share.

Japaul Gold and Tripple Gee & Co were down by 6.9 per cent each to close at 27k and 81k, respectively.

Overall the volume of shares traded stood at 86.59 million, representing a 72.86 per cent decrease from 319.09 shares at the previous session.

Also, the value of traded stocks dropped by 37.22 per cent to stand at

N1.17 billion compared with N1.86 billion recorded in Friday.

Guaranty Trust Holding Company (GTCO) was the most active stock, exchanging 19.47 million shares worth N385.59 million.

Sterling Bank followed with an account of 6.21 million shares valued at N9.35 million, while Zenith Bank traded 5.92 million shares worth N118.68 million.

Fidelity Bank sold 5.38 million shares valued at N20.02 million, while Chams exchanged 5.63 million shares worth N1.87 million.

Davido's Net Worth & Lifestyle

Davido's Net Worth & Lifestyle