BUSINESS

NESG boss, Awosika, others proffer solutions to rising inflation

Economic experts and captains of industries on Wednesday advocated collaboration between the fiscal and monetary policies to stem rising inlation in Nigeria.

The experts made the call at the Vanguard Economic Discourse with the theme, “Taming Inflation and Stimulating Growth: The Place of Fiscal and Monetary Policies”, in Lagos.

Mr Niyi Yusuf, Chairman, Nigerian Economic Summit Group (NESG), said that there was need for fiscal and monetary authorities to work together to support the economy.

“Nigeria must develop an integrated fiscal management strategy to expand the funding mix through Public Private Partnership PPP, innovative structured finance and contain inflation by reducing government’s recourse to the Central Bank of Nigeria (CBN).

“The CBN also needs to adopt a single market-reflective exchange rate and set a clear monetary policy framework that increases access to finance,” he said.

He also stressed the need to facilitate domestic trade and boost economic value addition through the removal of trade and foreign exchange restrictions.

He noted that weak fiscal performance, inflation, high interest rates, tightened monetary policy, oil sector relapse and external vulnerability drove Nigeria’s socioeconomic narrative in 2022.

He said statistics over the last eight years showed that while the Federal Government operated an expansionary fiscal policy, the monetary policy oscillated between contractionary and expansionary stances.

This, he said, would make taming inflation and sustaining growth in Nigeria unsuccessful and waste of time.

He said that strategic reform policies included petroleum subsidy removal, while establishing a compact which protects the poor and vulnerable from its effect.

Yusuf called for an increase in government’s expenditure efficiency and transparency, adding that all forms of untargeted tax waivers be reviewed.

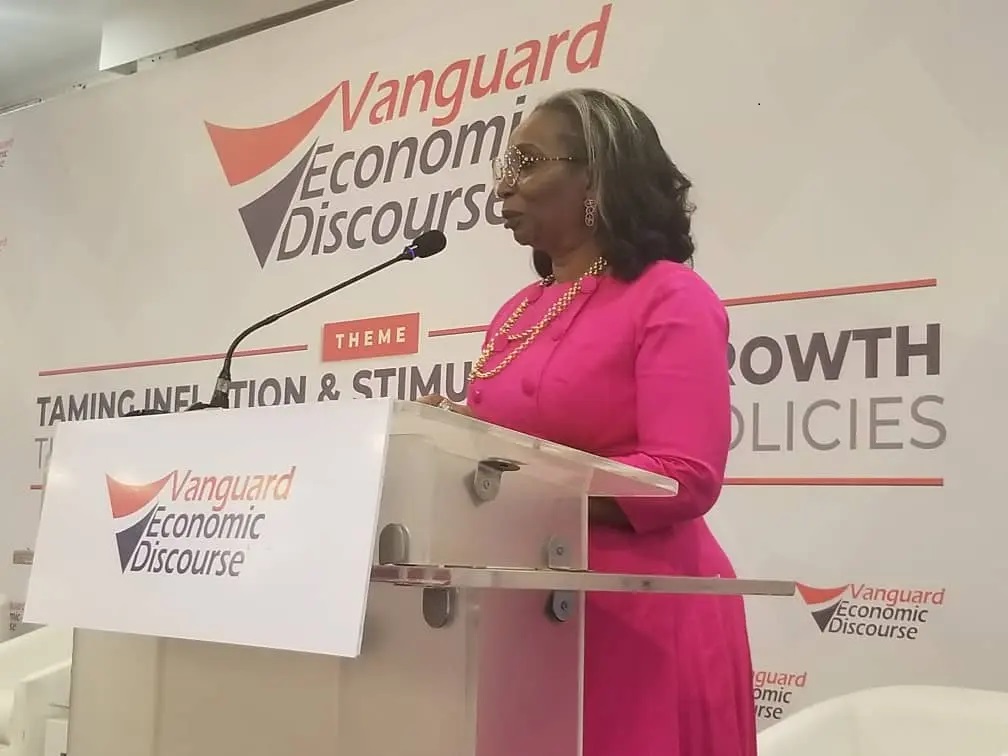

Mrs Ibukun Awosika, Chairman and Founder, Chair Centre Group, also emphasised the need for a holistic cohesiveness between fiscal and monetary policies.

She said that only the right people were needed to rejig the economy without destroying value.

According to her, the manufacturing sector more than any other has suffered the most of what the country’s economic woes, leading to flight of labour and investments.

“For those leaving the country, it sounds like good news for those that have not travelled before but it has its impact on the country’s ability to have the kind of manpower it needs to thrive.

“Our problems can be solved seeing that we have the might, the ability, the people; what we need is the sincerity of purpose and the media should stop being a partner in destroying the country.

“Remember, elections are coming; use your card, use it well,” she said.

Mrs Toyin Sanni, Group Chief Executive, Emerging Africa Capital Ltd., said that inflation would likely continue in the short to medium term due to intensified fuel and foreign exchange scarcity.

She suggested the use of several fiscal and monetary policy measures, such as reduction of government’s expenditure, improving infrastructure, increasing exports and transparency and reducing corruption as remedies to tame inflation.

“The CBN can lower money supply, use open market operations to control money circulation, increase transparency, and devalue the currency to increase exports, reduce imports; thus reducing trade deficit and inflation.

“There’s need for the CBN to drive financial inclusion some more by utilising technology,” she said.

Mr Godwin Emefiele, the CBN Governor, reiterated the apex bank’s commitment to keeping its eyes on monetary policies, to know when to step in to deliver policies that would regulate money supply.

Emefiele, represented by CBN Lagos Branch Controller, Mr Bariboloka Kayor, assured that the agency was doing its best to tame inflation.

“We believe that the economy of Nigeria is in our hands and both monetary and fiscal authorities have to work together,” he said.

Earlier, Mr Gbenga Adefaye, Editor-in-Chief, Vanguard Newspaper, said that the annual economic discourse was a platform for reviews and cross-fertilisation of ideas to proffer solutions to achieve Nigeria’s economic objectives.

Davido's Net Worth & Lifestyle

Davido's Net Worth & Lifestyle