BUSINESS

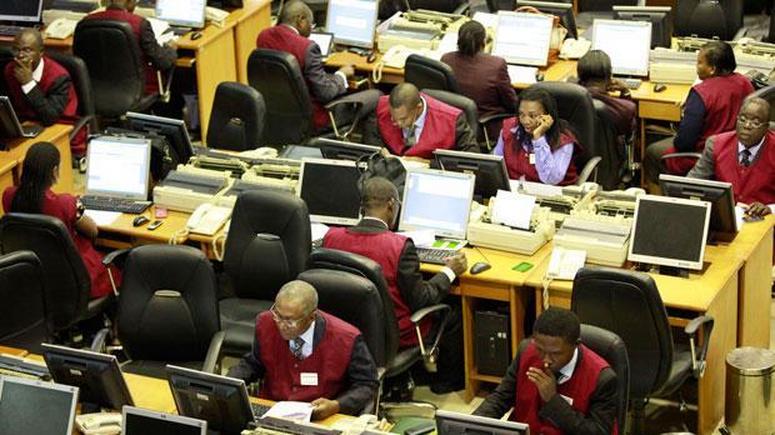

NGX All-Share Index crosses 80,000 benchmark, up by 0.83%

The Nigerian Exchange Ltd (NGX) All-Share Index on Monday crossed significant 80,000 basis points to settle at 80,324.53 benchmark by earning 0.83 per cent or 660 points, as against 79,664.66 recorded on Friday.

Consequently, the equity market capitalisation closed at N43.597 trillion as against N43.593 trillion recorded previously.

Specifically, the Year-To-Date (YTD) return rose by 7.42per cent as a total of 1.19bilion shares valued at ₦15.26bn were exchanged in 16,081 deals.

Analysis of today’s market activities indicated that buy interests in Tier-one banks – Zenith Bank, Fidelity Bank, Guaranty Trust Company and United Bank of Africa (UBA) – kept the market in the green.

Trade turnover settled higher relative to the previous session, as 53 equities were traded on the leader’s log, while 13 others were on the laggard’s log.

Meanwhile, Transcorp led the activity table in volume with an exchange of 298.30 million units shares valued at N4.08 billion, followed by First City Monumental Bank (FCMB), with 106.05million units shares of deals worth N1.1 billion.

Fidelity Bank exchanged 87.7 million units shares valued at N1.2 billion, while Sterling Nigeria traded 62.55 million units shares valued at N3.95 billion.

Unity Bank exchanged 32.57 million shares valued at N8.23 billion.

On the gainers table, Omatek, Cornerstone Insurance, Julius Berger, Jaiz bank and LASACO Assurance led in percentage terms of 10 each to close at 99k, N1.87, N46.75, N2.53 and N2.42 per share respectively.

Conversely, Daar Communication led the laggard’s table with 9.30 per cent to close at 12k, Eterna lost with 8.79 per cent to close at N1.45, while CWG Plc trailed by 7.05 per cent to close at 63k per share.

PZ also shed 6.90 per cent to close at N2.00 and Fidelity bank declined by 5.99per cent to close at 85k per share.

It was reported that some financial experts had previously predicted that trade on the Exchange would appreciate due to a wave of “buy the hype” which could make the ASI hit the 80,000 mark in the coming weeks.

Mr Adetola Freeman, Regional Analyst, FBS Africa, had noted that while the ASI may hit 80,000 mark, underlying economic factors could cause a decline in the enthusiasm of investors subsequently.

Freeman said that this might also pressure existing shareholders to sell off their holdings, which may trigger a bearish run in the market in another coming weeks.

Davido's Net Worth & Lifestyle

Davido's Net Worth & Lifestyle