BUSINESS

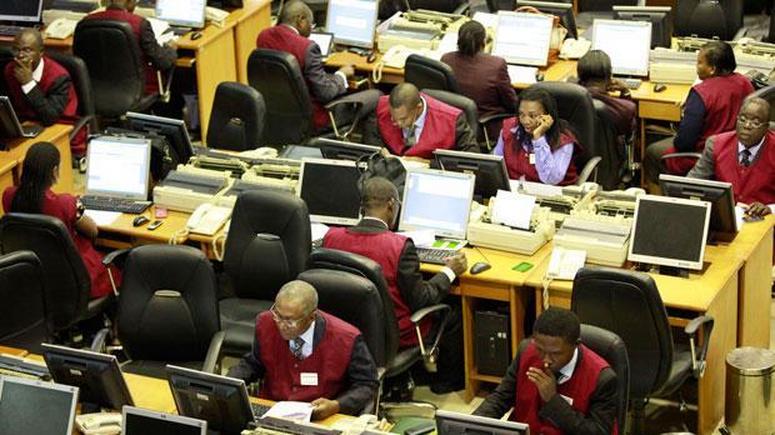

Investors’ buy interest in tier-1 banks, others drive stock market

The Nigerian equities extended its positive momentum with the market capitalisation increasing further by N317 billion.

Investors’ buy interest in stocks of Zenith Bank, Guaranty Trust Company (GTCO) and Seplat Energy lifted the market performance.

Specifically, investors gained N317 billion or 0.57 per cent, making the market capitalisation which opened at N55.583 trillion to closed at 55,900 trillion.

Similarly, the All-Share Index appreciated by 587.82 points or 0.57 per cent to 102,149.93 from 101,571.11 achieved on Wednesday.

A total of 504.19 million shares valued at N10.30 billion were exchanged in 12,235 deals.

As a result, the Year-To-Date (YTD) return rose to 36.61 per cent.

Also, market breadth closed positive with 32 equities on the advancers’ log and 26 others that declined.

On the gainers’ table, Seplat Energy and Universal Insurance led in percentage terms of 10 each to close at N3,074.60 and 44k per share, respectively.

AIICO Insurance followed by 9.89 per cent to close at N1.34, while Japaul Gold Group gained 9.80 per cent to close at N2.80 per share.

Also, May & Baker Nigeria Plc improved by 9.77 per cent to close at N7.30 per share.

Conversly, Ikeja Hotel led the losers’ table by 9.91 per cent to close at N7.18 per share.

Honeywell Flour Mills followed by 9.70 per cent to close at N4.47 per share.

Linkage Assurance trailed by 8.40 per cent to close at N1.20, while UPDC Real Estate Investment Trust lost 8.06 per cent to close at N5.70.

McNichols Plc shed 7.53 per cent to close at N1.35 per cent per share.

Meanwhile, United Bank of Africa (UBA) led the activity chart with 74.88 million shares traded at N2.25 billion.

Transcorp Hotel sold 34.19 million shares worth N581.08 million

Sterling Bank traded 33.07 million shares valued N210.44 million.

Also, Japaul Gold Group traded 31.93 million share valued at N87.98 million and Access Bank Holdings sold 27.49 million shares worth N7.89 billion.

Analysis of today’s market activities showed trade turnover settled higher relative to the previous session, with the value of transactions up by 28.19 per cent.

Davido's Net Worth & Lifestyle

Davido's Net Worth & Lifestyle