BUSINESS

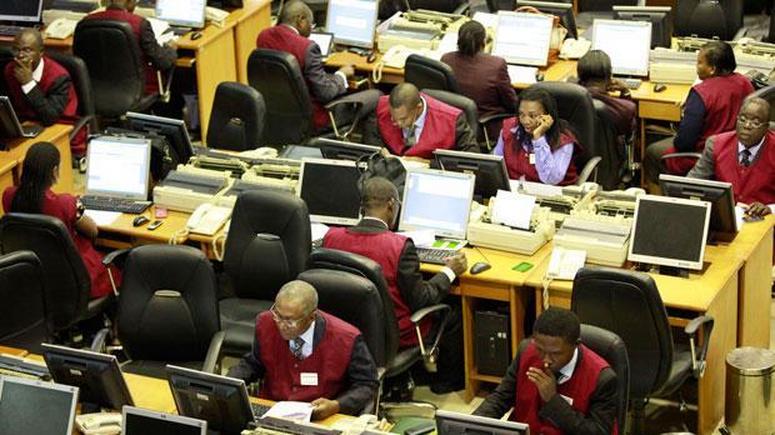

Bears resurface on NGX, capitalisation down N27bn

The bears resurfaced on the nation’s bourse on Thursday, halting gains posted in the last three trading sessions due to profit taking.

Specifically, the All-Share Index dipped 31.44 points or 0.18 per cent to close at 38,469.87 from 38,501.31 achieved on Wednesday.

Similarly, the market capitalisation lost N27 billion or 0.13 per cent to close at N20.043 trillion against N20.070 trillion on Wednesday.

Profit-taking in Guaranty Trust Bank Holding Company and 15 others dragged the All-Share Index (ASI) down by 0.08 per cent.

In summary, the All-Share Index (ASI) declined by 31.44 points, representing a loss of 0.08 per cent to close at 38,469.87 points.

Similarly, the overall market capitalisation shed N27 billion, representing a decrease of 0.13 per cent to close at N20.043 trillion.

The disparity between the ASI and the market capitalisation was due to the adjustment in the equity price of Fidson healthcare Plc (from N6.34 per share to N6.09 per share) for dividend payment.

The downturn of the market was driven by price depreciation in large and medium capitalised stocks amongst which are: NASCON Allied Industries, Guaranty Trust Bank Holding Company, Access Bank, Stanbic IBTC Holdings and United Bank for Africa.

The market closed negative with 16 losers against 12 gainers.

Prestige Assurances led the losers’ chart in percentage terms with 10 per cent to close at 45k per share.

Pharma-Deko followed with 9.70 per cent to close at N1.21, while University Press lost 7.88 per cent to close at N1.52 per share.

Wapic Insurance dipped 5.08 per cent to close at 56k, while Mutual Benefits Assurance shed 4.65 per cent to close at 41k per share.

On the other hand, NEM Insurance recorded the highest price to lead the gainers’ chart in percentage terms with 10 per cent to close at N2.20 per share.

Courteville Business Solutions came second with 9.52 per cent to close at 23k, while Nigerian Aviation Handling Company improved by 5.71 per cent to close at N2.59 per share.

Caverton Offshore Support Group rose by 4.42 per cent to close at N1.89, while Transcorp gained 4.40 per cent to close at 95k per share.

Also, the total volume of shares traded dropped by 19.5 per cent to 238.244 million shares valued N2.58 billion in 3,927 deals.

This was in contrast with a turnover of 296.09 million shares worth N2.56 billion achieved in 4,560 deals on Wednesday.

Transactions in the shares of Transcorp topped the activity chart with 34.44 million shares valued N32.14 million.

Courteville Business Solutions followed with 26.37 million shares worth N5.89 million, while Zenith Bank sold 23.66 million shares valued N590.35 million.

Fidelity Bank accounted for 20.45 million shares worth N47.42 million, while Chams transacted 15.12 million shares valued at N3.02 million.

Davido's Net Worth & Lifestyle

Davido's Net Worth & Lifestyle