BUSINESS

Investors lose N6b at NGX equities market

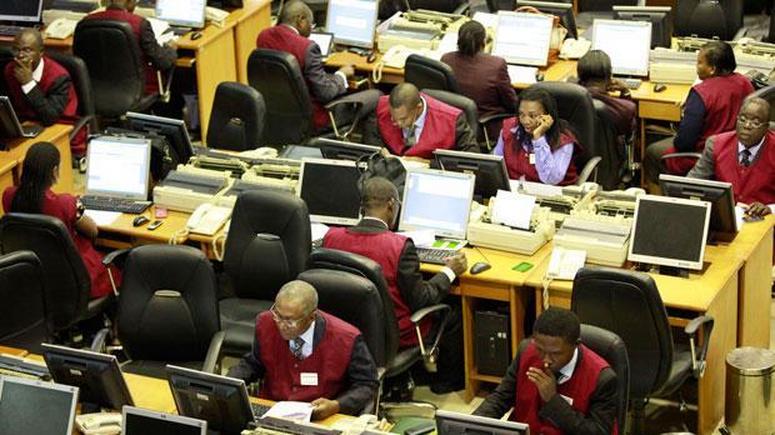

The equities market on the Nigerian Exchange Ltd. on Wednesday closed on a negative note as investors lost N6 billion.

The All-Share Index (ASI) marginally dropped by 0.02 per cent to stand at 46,766.16 points as against the 46.777.37 points posted on Tuesday.

This trading made the month-to-date and year-to-date performance of the All-Share Index decline by 0.42 per cent and 9.48 per cent respectively.

Similarly, the market capitalisation dipped by N6 billion to stand at N25.212 trillion from N25.218 trillion recorded the previous day, which represented 0.02 per cent decrease.

Analysts at Vetiva Research said, “Despite the positive activity seen in most of the sectors, the market declined due to negative sentiments mostly in the consumer goods sector.

“We are likely to see this bearish sentiment filter into tomorrow’s trading session, amid bargain hunting in some counters spurred by cheap valuations, and continued sell offs in other counters.”

The market breadth was negative as 18 stocks declined relative to 16 gainers.

Regal Insurance recorded the highest price gain of 10 per cent to close at 33k per share.

Livestock followed with a gain of 9.59 per cent to close at N1.66 per share, while Multiverse rose by 9.52 per cent to close at 33k per share.

Meyer rose by 9.30 per cent to close at 94k while Linkage Assurance gained 8.51per cent to close at 51k per share.

On the other hand, NPF Microfinance Bank led the losers’ chart by 9.78 per cent to close at N2.03 per share.

RTBriscoe depreciated by 8.93 per cent to close at 51k.

Prestige Insurance followed with a decline of 8.16 per cent to close at 45k per share while Cham and Niger Insurance lost 4.76 per cent each to close at 20k per share.

The total volume of stocks traded was 261.592 million units, valued N3.434billion, and exchanged in 4,668 deals.

Transactions in the shares of MTN Nigeria topped the most value chart with 1.79 million shares valued N380.26 million.

Guranty Trust Holding Company (GTCO) followed with 15.49 million shares worth N348.61 million, while Fidelity Bank traded 81.75 million shares valued N281.15 million.

Zenith Bank traded 10 million shares valued N277.33 million.

Davido's Net Worth & Lifestyle

Davido's Net Worth & Lifestyle