BUSINESS

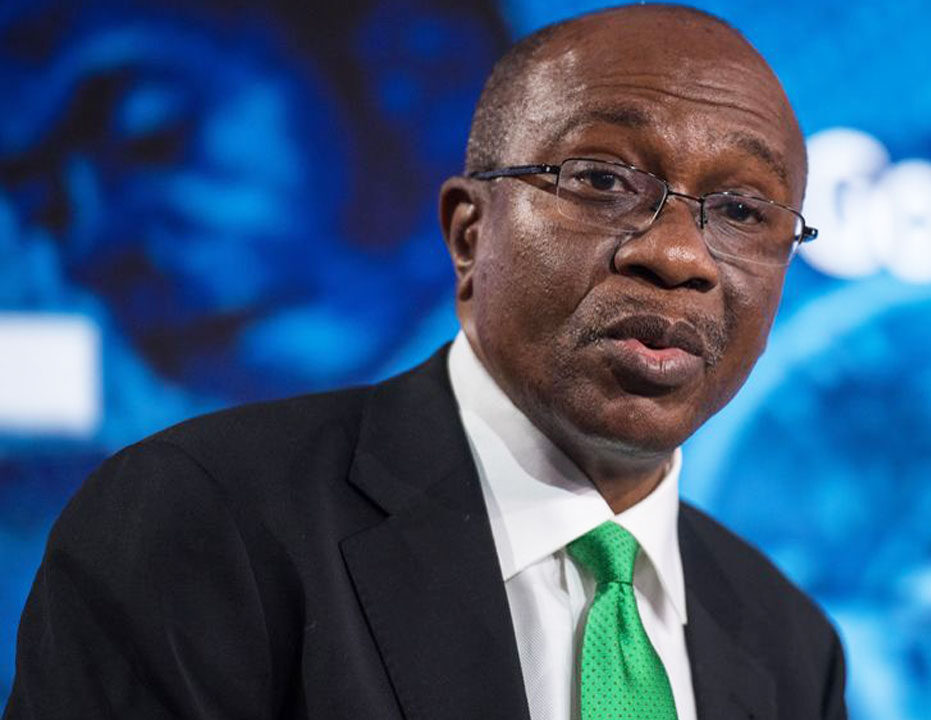

Experts project rates hike as CBN holds MPC meeting

As the Central Bank of Nigeria (CBN) holds its Monetary Policy Committee (MPC) meeting on Monday, some stakeholders project a hike in policy rates.

This is against the backdrop of global monetary policy trend, which has seen the American Central Bank (The Fed), and the Bank of England increasing Monetary Policy Rates (MPR).

It was reported that the MPR is the benchmark interest rate that guides all other rates in the financial market.

The MPC had raised the MPR by 100 basis points from 13 per cent to 14 per cent in its last meeting in July.

The July increase represented the second consecutive hike in the MPR within two months.

The committee had in May, and for the first time since September 2020, increased MPR by 150 basis points from 11.5 per cent to 13 per cent.

According to Prof. Umhe Uwaleke, an economist, the MPC is likely to increase the MPR again by at least 50 basis points.

Uwaleke, a Professor of Economics from Nasarawa State University, said that his projection was informed by rising inflation rates as well as the trend in some developed countries.

“Judging from the recent shift in monetary policy stance from accommodative to contractionary in deference to the CBN’s primary mandate of price stability.

“And against the backdrop of rising inflation, the MPC is most likely to increase the MPR by at least 50 basis points.

“Aside inflationary pressure and the need to tame it, the MPC will be considering current global monetary developments such as the hike in policy rates by central banks in developed countries.

“For example, the U.S. Federal Reserve recently increased the benchmark rate by 75 basis points while the Bank of England increased by 50 basis points,’’ he said.

Uwaleke said that these monetary tightening by central banks of U.S. and the UK continued to trigger capital outflows from Nigeria with negative implications on the exchange rate.

“So, the MPC will equally consider this as justification for increasing MPR,’’ he said.

The economist, however, urged the MPC to hold the prevailing rates constant as tightening may not tame inflationary trend.

“Be that as it may, if I were a member of the MPC, I would vote for a hold position. In other words, I would advise that the policy rates be held.

“This is because the major drivers of inflation in Nigeria today are cost-push related rather than demand-pull.

“Further policy tightening may not really tame inflationary pressures that are stemming more from high cost of energy and negative impact of insecurity on food output.

“Furthermore, any hike in rate at this time will hurt output growth through higher cost of lending to SMEs.

“In view of the current tepid real GDP growth, I will advise the MPC to maintain the status quo and give more time to the current CBN monetary policy to permeate the economy,’’ he said.

Dr Tope Fasua, an economist, also urged the MPC to retain the subsisting rates as past rates increase had not tamed inflation.

“Though I expect that they may further raise rates, my advice to the MPC will be that they hold rates.

“We have raised rates by 250 basis points in the last two meetings, but inflation has surged further.

“This means that our own inflation is not tightly linked with interest rates and may recede in its own time.

“Ours is a bit of a carryover from the COVID-19 era of production shut down and imported inflation because our economy is dependent on foreign ones battling inflation presently,’’ he said.

According to Fasua, raising rates further will only be a continuation of punishment for local industries that borrow locally and are struggling to achieve previous levels of productivity post COVID-19.

“Banks are always quick to raise lending rates anyway. The CBN had to recently force them to increase savings rates.

“Their margins are always so high, so the committee and CBN must be careful about raising rates,’’ he said.

A financial expert, Mr Okechukwu Unegbu, urged fiscal and monetary authorities to look beyond the MPC and work together to save the economy from negative external influence.

Unegbu is a past President of the Chattered Institute of Bankers of Nigeria (CIBN).

He particularly decried the negative effect of the Russian-Ukrainian conflict on the Nigerian economy and called for policies decisions that could insulate the Nigerian economy from such incidents.

Davido's Net Worth & Lifestyle

Davido's Net Worth & Lifestyle